Understanding Business Expenses: A Guide for Sole Traders and Limited Companies When it comes to running a business, knowing what...

Understanding Business Expenses: A Guide for Sole Traders and Limited Companies When it comes to running a business, knowing what...

Accountant London, small business accounting, tax savings Running a business in London means facing higher costs and complex tax rules....

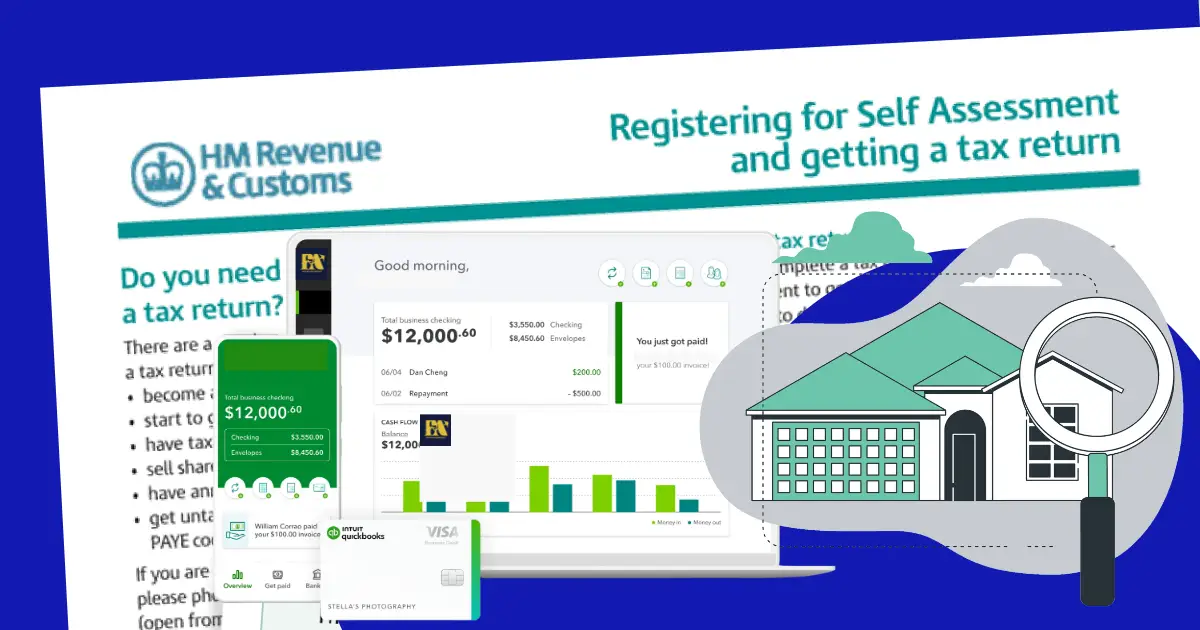

ou must register for VAT if your taxable turnover (sales that aren’t VAT-exempt) goes over £90,000 in a rolling 12-month...

Sole Trader vs Limited Company: Key Differences Explained If you’re starting a business, one of the first decisions you’ll face...

Yes — if you run a limited company, you can be both a director and shareholder. This gives you flexibility...

For Self-Employed / Sole Traders: Self Assessment tax return deadline: 31 January (following the end of the tax year). Example:...

Reliable accountancy services for individuals, startups, and established businesses in London. From bookkeeping to year-end accounts, we’ve got your numbers covered.