For Self-Employed / Sole Traders:

-

Self Assessment tax return deadline: 31 January (following the end of the tax year).

-

Example: 2024–25 tax year ends 5 April 2025 → return and payment due by 31 January 2026.

-

You may also need to make Payments on Account (advance tax payments in January and July).

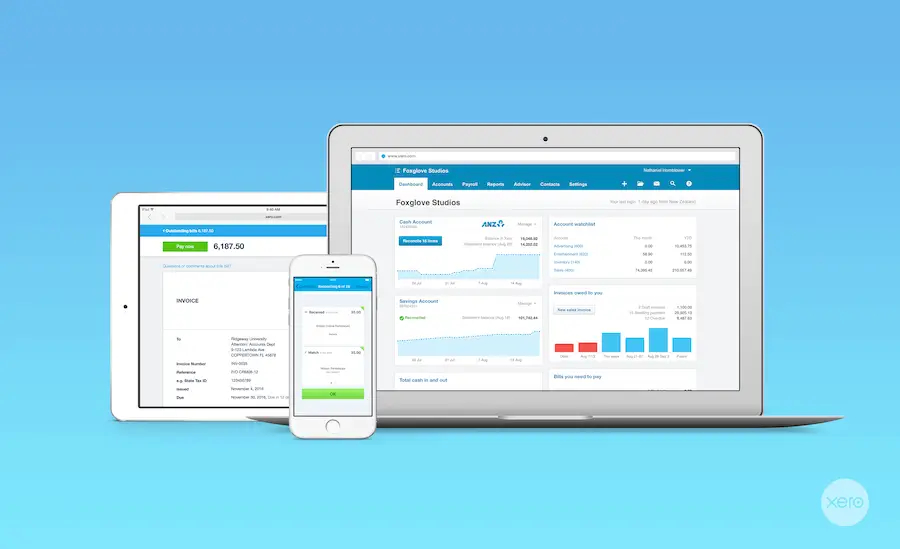

For Limited Companies:

-

Corporation Tax is due 9 months and 1 day after your company’s accounting year-end.

-

Example: Year-end 31 March → Corporation Tax due 1 January.

You may also have:

-

PAYE deadlines (if you employ staff)

-

VAT returns (usually quarterly)

Missing deadlines results in automatic penalties and interest, so it’s vital to stay on top of it. A good accountant will track these for you and help spread out your cash flow accordingly.